Staff Classification and Compensation Project

The Staff Classification and Compensation Project establishes a new framework to help the university provide a more transparent, consistent and market-competitive job classification and compensation structure.

For in-scope staff, the project categorizes jobs at the university by job families and subfamilies,

career streams and levels, and job profiles based on the type of work, responsibilities,

skills required, level of authority and other factors. You are encouraged to learn

more about the project’s key components ahead of the initial implementation of the

university’s new job classification and compensation structure on Oct. 1, 2024.

Job Families and Subfamilies

Staff positions are categorized into 18 job families (e.g. Finance, Student Services) and 90 subfamilies (e.g. Accounting, Academic Advising).

View Job Families and SubfamiliesCareer Streams and Levels

Staff positions are categorized into three career streams. Each stream contains levels that define career progression toward more job complexity, knowledge and responsibility.

View Career Streams & LevelsJob Profiles

Job profiles provide high-level definitions of the purpose, responsibilities and qualifications for specific positions. More than 750 job profile summaries are available now with more details coming later.

View Job Profile Summaries (Excel)Staff Pay Structure

The pay structure consists of 20 pay grades. Each grade defines a range minimum, midpoint and maximum pay.

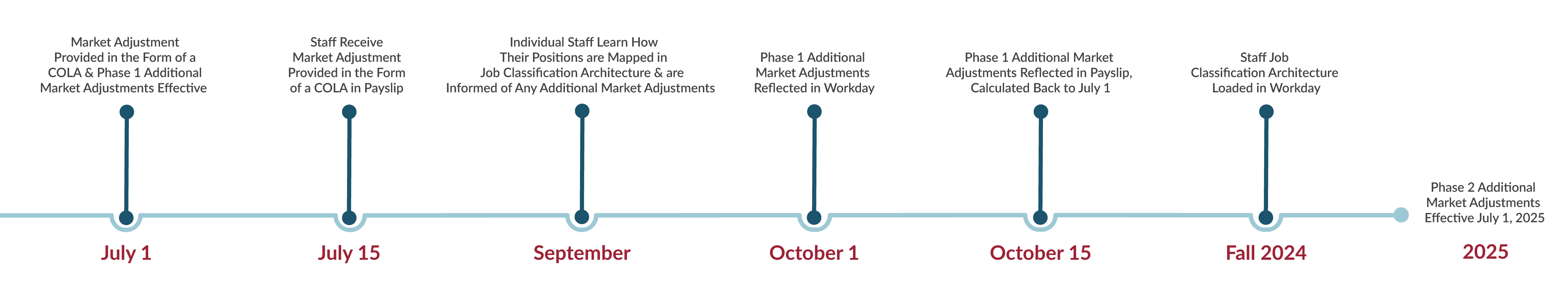

View Pay StructureMarket Adjustments

Many staff may receive an additional market adjustment to their base pay in two phases following the Staff Classification and Compensation Project’s market analysis.

View Market AdjustmentsProject Background

The university initiated a campuswide project designed to better attract, develop and retain talented staff including a significant investment in staff compensation and resources.

View Project BackgroundFiscal Year 2025 Key Dates

Job Classification Architecture and Career Paths

For more information, see the full Staff Job Classification Architecture and Career Paths video.

Key Definitions

In-Scope Staff: In-scope positions include University of Arkansas, Fayetteville full-time, appointed staff and provisional positions employed by May 1, 2024, except athletic coaches and certain executive level positions (i.e., VCs, VPs, Chancellor). Extra help, contingent workers, and work-study positions including part-time positions are excluded. In addition, positions that include at least a 51% Division of Agriculture (UADA) split are out-of-scope.

Job Classification Architecture: A framework to organize and structure the various positions. It provides a systematic

way of categorizing and classifying different work based on factors such as responsibilities,

qualifications, skills, and other job-related characteristics.

Market: To evaluate university classification and compensation in relation to the market for

similar positions, the project utilized a benchmarking process that included a blend

of higher education, regional and national industry data. Learn more on the Project Background page.

Market Adjustment: The adjustment to the rate of pay eligible staff employees may receive, with time in position factored in. Learn more on the Market Adjustment Implementations page.

Job Description: Job descriptions are sometimes referred to as position restrictions in Workday. Different than a job profile, a job description defines a specific job within a team, unit and organization. It contains a detailed description of responsibilities, reporting lines, and knowledge, skills and abilities. Multiple job descriptions can be mapped to one job profile. For example, there may be many Academic Advisors across campus that generally perform the same work, but there may be specific duties performed in Walton College vs. the College of Engineering.

Job Profile: Different than a job description, a job profile is a high-level, general definition of a job’s purpose, responsibilities, and qualifications, used to enhance consistency in the way jobs are defined across the university within the job classification architecture. A job profile may contain multiple job descriptions. Job profiles apply to positions throughout the university, in separate departments, that perform similar work.

View All DefinitionsBenefits For In-Scope* Staff

- Clearer career pathways and tools to support growth and potential progression

- Clearer job performance expectations

- Consistent pay structure across campus

- Compensation that is more competitive with the market based on the work performed

Benefits For the University

- Increased ability to attract and retain top talent

- Increased ability to promote consistent pay among positions with similar responsibilities

- Greater clarity and efficiency of processes and administration of compensation

- Establishment of a sustainable infrastructure designed to enhance competitiveness in the market through changes in the workforce and industry

Frequently Asked Questions

About The Project

About Classification

Job profile: Different than a job description, a job profile is a high-level, general definition of a job’s purpose, responsibilities, and qualifications, used to enhance consistency in the way jobs are defined across the university within the job classification architecture. A job profile may contain multiple job descriptions. Job profiles apply to positions throughout the university, in separate departments, that perform similar work.

A career path is a series of jobs an employee may consider as they work toward career goals. Career goals and potential career paths are unique based on individual motivations and aspirations.

The university’s job classification architecture is intended to provide more transparency into what jobs are available and the knowledge, skills, abilities and competencies that are typically required for different jobs so staff can be better prepared and equip themselves with the necessary skills when they are ready to pursue their career journey. This job classification structure is designed to help staff develop a roadmap for considering other opportunities and potential movement within the university. It’s also designed to help supervisors with talent management practices and plan for workforce needs.

About Compensation

Not all in-scope staff will receive an additional market adjustment. For instance, if a staff member’s base pay, with time-in-position considered, is already within the assigned market pay range for the work they perform, they would not receive an additional market adjustment (beyond the previous market adjustment provided in the form of a COLA received July 1, 2024).

In addition, staff with a "needs improvement" or "unsatisfactory" performance rating will not receive an additional market adjustment (beyond the previous market adjustment provided in the form of a COLA received July 1, 2024).*

No employee’s pay will decrease as a result of the project – even if the employee’s current base pay is above the market pay range for similar work performed.

*Staff with a "needs improvement" or "unsatisfactory" performance rating from the Spring 2024 evaluation period will not receive an additional market adjustment in phase one but would become eligible for potential market adjustments in phase two if documented performance is improved to at least a satisfactory level during the calendar-year review cycle.

The amount of time (from one month to 30 years) an in-scope staff member has been working in their current position – not their total time of employment at the university – is factored into potential market adjustments beyond the previous market adjustment provided in the form of a COLA received July 1, 2024. Time-in-position is considered both for in-scope employees with base pay below the market pay range minimum and those already within the market pay range at the point of project implementation.

Those with base pay above the market pay range maximum are not eligible for time-in-position consideration. The amount of any potential time-in-position increase is limited to 10% of an employee’s base pay OR to 10% of the market pay range minimum for the work they perform (for employees with base pay currently below the market pay range minimum). Please note that if a staff member’s base pay, with time-in-position considered, is already within the assigned market pay range for the work they perform, they would not receive an additional market adjustment (beyond the previous market adjustment provided in the form of a COLA received July 1, 2024).

Taxes will be withheld on any market adjustments as required by the IRS. Below are common questions about tax implications:

Q: Will the larger Oct. 15 payment be subject to IRS supplemental wages and taxed at a flat 22% federal tax rate?

A: No. The payment is being computed as regular wages (not as supplemental wages) for the semimonthly pay period.

Q: How can I estimate what the taxes will be on the Oct. 15 payment?

A: Once you know the payment amount, you may utilize the “Model My Pay” feature in Workday to add the earning amount and review the tax deductions. Model My Pay also allows hypothetical changes to the tax elections.

Q: How do I adjust tax elections if necessary?

A: You can use the “Update Withholding Elections” feature in Workday.

Per Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, nonresidents must follow special instructions when completing Form W-4, Employee's Withholding Certificate. If you are a foreign national, please contact Andrea Crawford at nratax@uark.edu for assistance.

Q: Will the Oct. 15 payment be subject to mandatory and voluntary retirement contributions?

A. Yes. The payment is subject to retirement contributions.

Salaries for some positions may fall within a higher benefits salary threshold, which could potentially increase the amount of an employee's contributions depending on their benefits elections.

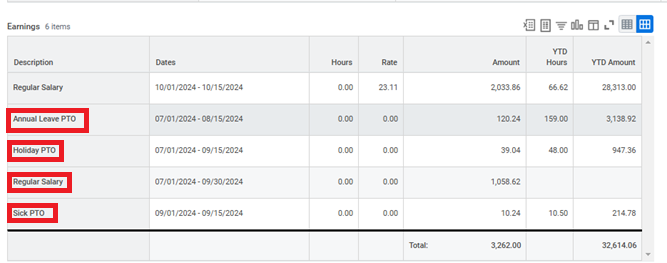

In Workday, you can view your phase one market adjustment – including the total amount accumulated effective July 1, 2024, until Oct. 1, 2024 - in the Oct. 15, 2024, payslip. The adjustment representing the portion of a staff member’s appointment period before October 1 will be noted under the “Earnings” table and shown as Holiday PTO, Annual Leave PTO, Sick PTO or Regular Salary with dates prior to Oct. 1, 2024. See the below example for more guidance on where you can find this information. You can also view all previous changes to your pay under "Compensation" and "Pay Change History" on your profile in Workday. Learn more about how to read your payslip and retroactive pay from financial affairs.

No. Parking fees are updated based on an employee's salary at the time of the purchase, so market adjustments should not change the amount of a parking pass payment until the employee renews for FY26.

Any potential future Cost-of-Living-Adjustment (COLA) recommendations wouldn’t be contemplated until 2025, and would require both adequate financial resources and approval from the UA System Board of Trustees. Please note: If a potential COLA were to be approved effective July 1, 2025, additional market adjustments for Phase 2 might vary.

Thank you to the countless staff members who provided feedback during the course of this project. We listened and took action by incorporating suggestions and providing more information about the various components of the project including the answers to these frequently asked questions.

Please send any additional questions or suggestions to the project team at ccproj@uark.edu.