Time-in-Position Overview & Calculations

Time-in-Position (TIP) calculations are designed to help provide fair and consistent recognition of the experience in-scope staff members have gained in their current positions. Staff are credited for time in their current position – not their total time of employment at the university – starting in one-month increments all the way up to 30 years.

TIP calculations were factored into additional market adjustments beyond the previous market adjustment provided in the form of a COLA received July 1, 2024.

- TIP calculations are intended to help move employees with some, but relatively less time in position past the minimum and closer to the midpoint of the pay grade assigned to their job profiles, while potentially helping move employees with more time in position even further along the pay grade assigned to their job profiles.

- TIP is considered for in-scope employees with base pay below the market pay range minimum as well as those already within the market pay range at the point of project implementation.

- Staff with base pay above the assigned market pay grade maximum are not eligible for TIP consideration.

- The amount of any potential TIP increase is limited to 10% of an employee’s base pay OR to 10% of the market pay grade minimum for the work they perform (for employees with base pay currently below the market pay range minimum).

- Please note that if a staff member’s base pay, with TIP considered, is already within the assigned market pay range for the work they perform, they would not receive an additional market adjustment (beyond the previous market adjustment provided in the form of a COLA received July 1, 2024).

Example Scenarios of Time-in-Position Calculations

Please note that the formulas are consistent for staff members with less than 10 years of time in their current position (TIP), but are adjusted for employees with more than 10 years of TIP, and for employees with more than 30 years of TIP.

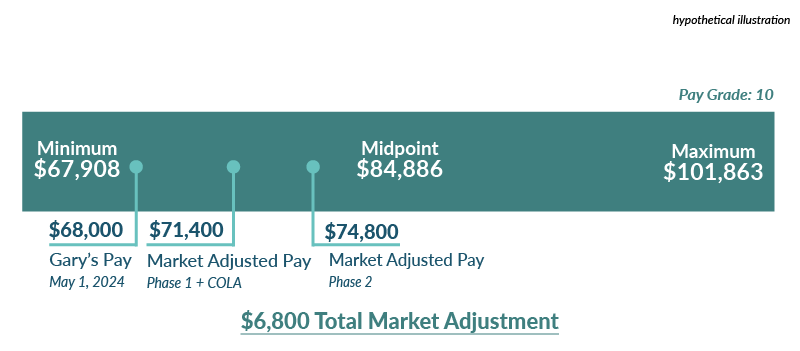

Gary's Scenario Details

Time in Current Position (TIP): 8 years

Pay Grade: 10 (min/mid/max = $67,908/$84,886/$101,863)

May 1, 2024 Pay: $68,000

Since Gary was already above the pay grade minimum for his position and had less than 10 years of time in his current position, a market adjustment would be based on the lesser of two formulas.

Formula 1

Pay Grade Midpoint – Pay Grade Minimum

÷ 10

x TIP (8 years)

+ Pay Grade Minimum

Actual Math

$84,886 - $67,908

= $16,978 ÷ 10

= $1,697.80 x 8

= $13,582.40 + $67,908

= $81,490

Formula 2

May 1, 2024 Pay x 10% Cap

+ May 1, 2024 Pay

Actual Math

$68,000 x .10

= $6,800 +$68,000

= $74,800

In this example, Gary’s market rate would be $74,800 and his total market adjustment would be $6,800.

Because he’s in a subfamily assigned to a 50/50 distribution of the total market adjustment, he would receive:

- $3,400 in phase 1 ($2,040 COLA + $1,360 additional adjustment)

- $3,400 in phase 2 ($3,400 additional market adjustment)

Gary's market adjusted pay would be: $71,400, effective July 1, 2024, and $74,800, effective July 1, 2025.

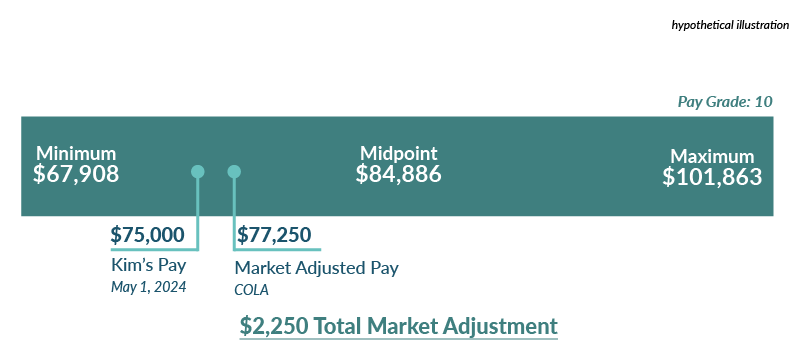

Kim's Scenario Details

Time in Current Position (TIP): 3 years

Pay Grade: 10 (min/mid/max = $67,908/$84,886/$101,863)

May 1, 2024 Pay: $75,000

Since Kim was already above the pay grade minimum for her position and had less than 10 years of time in her current position, a market adjustment would be based on the lesser of two formulas.

Formula 1

Pay Grade Midpoint – Pay Grade Minimum

÷ 10

x TIP (3 years)

+ Pay Grade Minimum

Actual Math

$84,886 - $67,908

= $16,978 ÷ 10

= $1,697.80 x 3

= $5,093.40 + $67,908

= $73,001

Formula 2

May 1, 2024 Pay x 10% Cap

+ May 1, 2024 Pay

Actual Math

$75,000 x .10

= $7,500 + $75,000

= $82,500

While Kim’s assigned market rate would be $73,001, she would not receive an additional market adjustment (beyond COLA in the form of a market adjustment) because her May 1, 2024 salary was already above the assigned market rate for her position.

Kim's market adjusted pay would be $77,250 ($2,250 COLA), effective July 1, 2024.

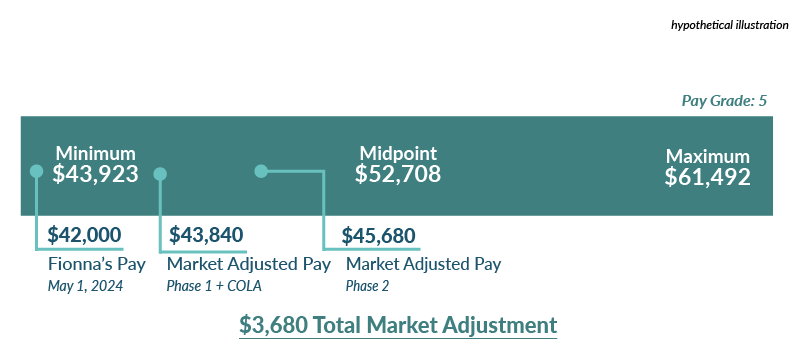

Fionna's Scenario Details

Time in Current Position (TIP): 2 years

Pay Grade: 5 (min/mid/max = $43,923/$52,708/$61,492)

May 1, 2024 Pay: $42,000

Since Fionna was below the pay grade minimum for her position and had less than 10 years of time in her current position, a market adjustment would be based on the lesser of two formulas.

Formula 1

Pay Grade Midpoint – Pay Grade Minimum

÷ 10

x TIP (2 years)

+ Pay Grade Minimum

Actual Math

$52,707 - $43,923

= $8,784 ÷ 10

= $878.40 x 2

= $1,756.80 + $43,923

= $45,680

Formula 2

May 1, 2024 Pay x 10% Cap

+ May 1, 2024 Pay

Actual Math

$43,923 x .10

= $4,392 + $43,923

= $48,315

So, Fionna’s market rate would be $45,680 and her total market adjustment would be $3,680.

Because she’s in a subfamily assigned to a 50/50 distribution of the total market adjustment, she would receive:

- $1,840 in phase 1 ($1,260 COLA + $580 additional market adjustment)

- $1,840 in phase 2 ($1,840 additional market adjustment)

Fionna's market adjusted pay would be $43,840, effective July 1, 2024, and $45,680, effective July 1, 2025.

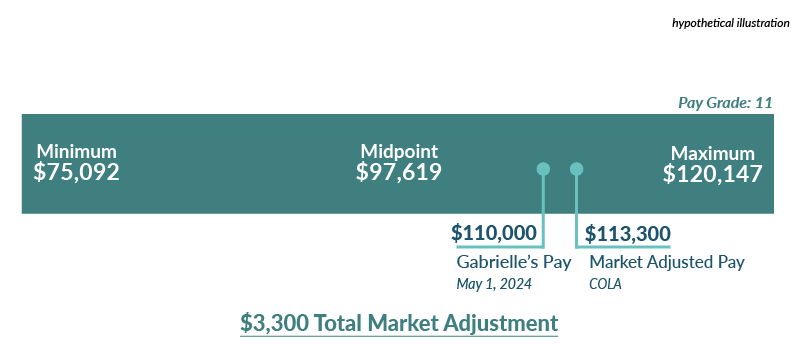

Gabrielle's Scenario Details

Time in Current Position (TIP): 20 years

Pay Grade: 11 (min/mid/max = $75,092/$97,619/$120,147)

May 1, 2024 Pay: $110,000

Since Gabrielle was already above the pay grade minimum for her position and had more than 10 years in her current position, a potential market adjustment would be based on the lesser of two formulas.

Formula 1

Pay Grade Maximum – Pay Grade Midpoint

÷ 20

x TIP (20 years – 10)

+ Pay Grade Midpoint

Actual Math

$120,147 - $97,619

= $22,528 ÷ 20

= $1,126.40 x (20 – 10)

= $11,264 + $97,619

= $108,883

Formula 2

May 1, 2024 Pay x 10% Cap

+ May 1, 2024 Pay

Actual Math

$110,000 x .10

= $11,000 +$110,000

= $121,000

While Gabrielle’s assigned market rate would be $108,883, she would not receive an additional market adjustment (beyond COLA in the form of a market adjustment) because her May 1, 2024, salary was already above the assigned market rate for her position.

Gabrielle's market adjusted pay would be $113,300 ($3,300 COLA), effective July 1, 2024.

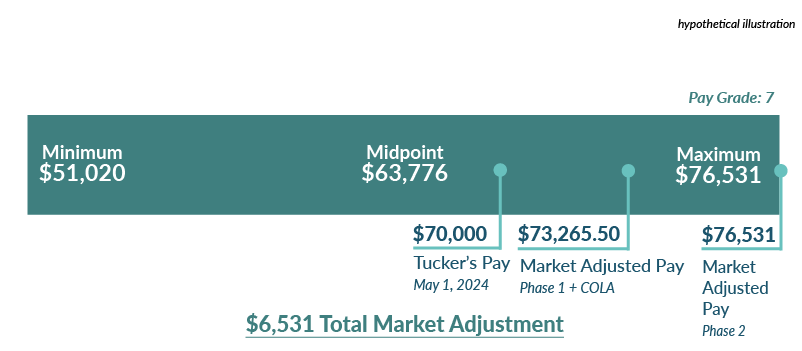

Tucker's Scenario Details

Time in Current Position (TIP): 42 years

Pay Grade: 7 (min/mid/max = $51,020/$63,776/$76,531)

May 1, 2024 Pay: $70,000

Since Tucker was already above the pay grade minimum for his position and had more than 30 years of time in his current position, a market adjustment would be based on the lesser of two formulas.

Formula 1

Pay Grade Maximum

Actual Math

$76,531

Formula 2

May 1, 2024 Pay x 10% Cap

+ May 1, 2024 Pay

Actual Math

$70,000 x .10

= $7,000 + $70,000

= $77,000

So, Tucker’s assigned market rate would be $76,531, and his total market adjustment would be $6,531.

Because he’s in a subfamily assigned to a 50/50 distribution of the total market adjustment, he would receive:

- $3,265.50 in phase 1 ($2,100 COLA + $1,165.50 additional market adjustment)

- $3,265.50 in phase 2 ($3,265.50 additional market adjustment)

Tucker's market adjusted pay would be $73,265.50, effective July 1, 2024, and $76,531, effective July 1, 2025.