Staff Classification and Compensation Project

The Staff Classification and Compensation Project establishes a new framework to help the university provide a more transparent, consistent and market-competitive job classification and compensation structure.

For in-scope staff, the project categorizes jobs at the university by job families and subfamilies,

career streams and levels, and job profiles based on the type of work, responsibilities,

skills required, level of authority and other factors. You are encouraged to learn

more about the project’s key components ahead of the initial implementation of the

university’s new job classification and compensation structure on Oct. 1, 2024.

Job Families and Subfamilies

Staff positions are categorized into 18 job families (e.g. Finance, Student Services) and 91 subfamilies (e.g. Accounting, Academic Advising).

View Job Families and SubfamiliesCareer Streams and Levels

Staff positions are categorized into three career streams. Each stream contains levels that define career progression toward more job complexity, knowledge and responsibility.

View Career Streams & LevelsJob Profiles

Job profiles provide high-level definitions of the purpose, responsibilities and qualifications for specific positions. More than 750 job profile summaries are available now with more details coming later.

View Job Profile Summaries (Excel)Staff Pay Structure

The pay structure consists of 20 pay grades. Each grade defines a range minimum, midpoint and maximum pay.

View Pay StructureMarket Adjustments

Many staff may receive an additional market adjustment to their base pay in two phases following the Staff Classification and Compensation Project’s market analysis.

View Market AdjustmentsProject Background

The university initiated a campuswide project designed to better attract, develop and retain talented staff including a significant investment in staff compensation and resources.

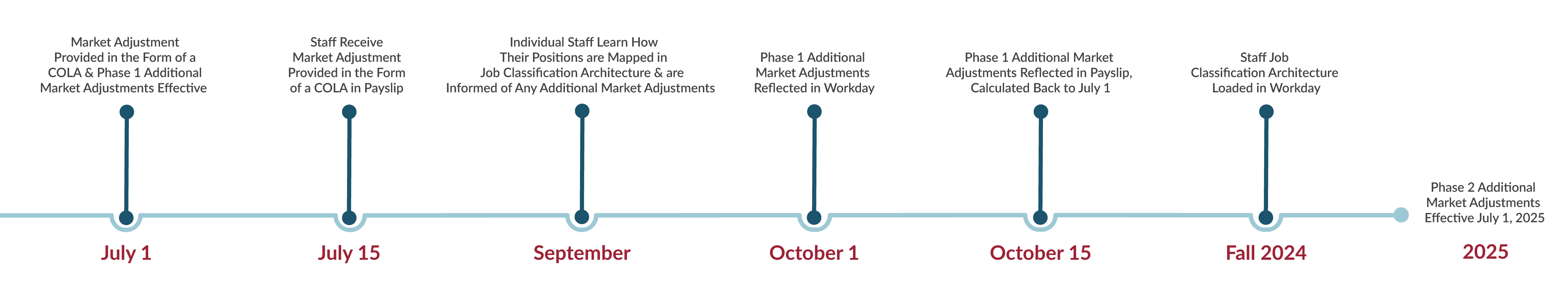

View Project BackgroundFiscal Year 2025 Key Dates

Job Classification Architecture and Career Paths

For more information, see the full Staff Job Classification Architecture and Career Paths video.

Key Definitions

In-Scope Staff: In-scope positions include University of Arkansas, Fayetteville full-time, appointed staff and provisional positions, except athletic coaches and certain executive level positions (i.e., VCs, VPs, Chancellor). Extra help, contingent workers, and work-study positions including part-time positions are excluded.

Job Classification Architecture: A framework to organize and structure the various positions. It provides a systematic

way of categorizing and classifying different work based on factors such as responsibilities,

qualifications, skills, and other job-related characteristics.

Market: To evaluate university classification and compensation in relation to the market for

similar positions, the project utilized a benchmarking process that included a blend

of higher education, regional and national industry data. Learn more on the Project Background page.

Market Adjustment: The adjustment to the rate of pay eligible staff employees may receive, with time in position factored in. Learn more on the Market Adjustment Implementations page.

View All DefinitionsBenefits For In-Scope Staff

- Clearer career pathways and tools to support growth and potential progression

- Clearer job performance expectations

- Consistent pay structure across campus

- Compensation that is more competitive with the market based on the work performed

Benefits For the University

- Increased ability to attract and retain top talent

- Increased ability to ensure pay equity among positions with similar responsibilities

- Greater clarity and efficiency of processes and administration of compensation

- Establishment of a sustainable infrastructure designed to enhance competitiveness in the market through changes in the workforce and industry

Frequently Asked Questions

About The Project

About Classification

About Compensation

Taxes will be withheld on any market adjustments as required by the IRS. Below are common questions about tax implications:

Q: Will the larger Oct. 15 payment be subject to IRS supplemental wages and taxed at a flat 22% federal tax rate?

A: No. The payment is being computed as regular wages (not as supplemental wages) for the semimonthly pay period.

Q: How can I estimate what the taxes will be on the Oct. 15 payment?

A: Once you know the payment amount, you may utilize the “Model My Pay” feature in Workday to add the earning amount and review the tax deductions. Model My Pay also allows hypothetical changes to the tax elections.

Q: How do I adjust tax elections if necessary?

A: You can use the “ Update Withholding Elections” feature in Workday.

Q: Will the Oct. 15 payment be subject to mandatory and voluntary retirement contributions?

A. Yes. The payment is subject to retirement contributions.

Any potential future Cost-of-Living-Adjustment (COLA) recommendations wouldn’t be contemplated until 2025, and would require both adequate financial resources and approval from the UA System Board of Trustees. Please note: If a potential COLA were to be approved effective July 1, 2025, additional market adjustments for Phase 2 might vary.

Thank you to the countless staff members who provided feedback during the course of this project. We listened and took action by incorporating suggestions and providing more information about the various components of the project including the answers to these frequently asked questions.

Please send any additional questions or suggestions to the project team at ccproj@uark.edu.